Saudi Arabia's Oil Minister Ali al-Naimi said:

"I don't like to talk about oil because we want calmness," Naimi said when questioned by reporters.

"Why do you want to bring up the prices issue? Leave the prices alone." [Reuters]

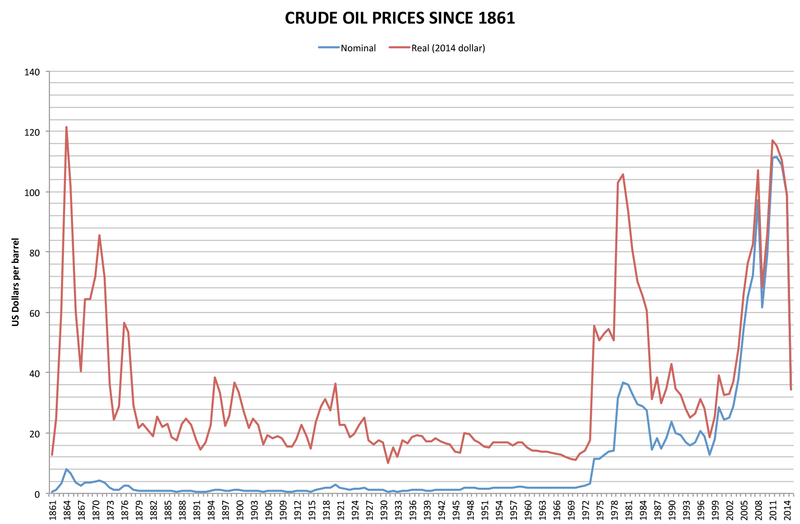

As long as OPEC will not change production based on market trends, the idea that oil prices should remain calm are false. History shows that oil prices are very volatile. The reason is easy for economists to explain. The demand for oil is very inelastic and the supply is also very inelastic. The result is small changes to either the demand or supply can force extreme short-term price responses. These extreme short-term fluctuations in oil prices can be seen in the long term chart below:

In fact oil prices were so volatile that the Texas Railroad Commission had a goal of price stabilization. "Before OPEC took center stage, one state agency in Texas was widely believed to set oil prices for the world." [The Texas Railroad Commission by William Childs].

If OPEC truly retreats from price setting, then almost by definition, oil price volatility will increase. Without a 'guiding hand' not just a small increase in oil price volatility, but volatility will skyrocket. For example, a range of $20-$200 every year is not out of the question. Why?

As stated earlier, the elasticity of BOTH supply and demand is very low. It takes a HUGE price swing to change either. For example, to cut supply it takes a price below the marginal cost of production. But with oil wells, almost all the cost is sunk. Most of the cost is to drill the well, not produce the oil. Thus, once the well is drilled it takes an absurd price to stop production (like $20). On the other hand, consumption is also inelastic. For example, to get people to trade in their electric car for a truck will require a huge change in price of gasoline. To change the consumption of gasoline, you need a huge change that wakes people up and occurs over time. Thus to get a 10% increase in gasoline sold, you need 50% or more change in price for many weeks if not months. Thus, for either supply or demand to change significantly, you need a HUGE change in price.

But that creates a problem over time. If the price falls to $20, demand jumps 6 months later. At the same time as wells deplete and no new wells are drilled, the amount supplied also falls. To get production increasing, you then need a price above $100. So the price starts to skyrocket. After $150, demand starts to decrease but supply surges and then you have too much oil. Now to get supply to decrease and demand to increase back to $20. Without OPEC changing production, the price will have to change dramatically down and dramatically up. The volatility of oil prices is headed to insane levels, if OPEC has truly stopped it's price setting.

The conclusion is either OPEC starts moderating price by changing production or the price of oil will become very very very volatile.

No comments:

Post a Comment