As of today, the following is my take on the candidates:

A) HRC: She is in real trouble. The reason is she cannot lie. Her handling of the email problem has been more than worse: it could kill her candidacy. Why? Because two important things people look for in a President: 1) Can the candidate understand me and do I understand the candidate?

2) Why does the candidate want the job?

In both of these she fails on the email problem. First, everyone who works understands the idea of having a 'work' email and 'home' email. The fact that she did not want to be 'bothered' by two emails, shows an elitism that separates her from the 'average Jane' (or Joe). She is just not like an 'average' person, but is 'above' all that. That is one way to kill a presidential campaign. Second, her lies were so obvious to be insulting. You are an idiot and I can lie straight to your face and you don't know it.

People don't expect a candidate to tell the truth 100% of the time. But if they do lie, they at least want them to be good at it. She fails on all accounts.

A second major problem is "the vision thing". Recall Pres. Bush (the first one) had a 'vision problem'. He had no idea why he was going to be President. HRC has "to be the first woman", but that's it.

Yes she has a ton of position papers, but why does she want to be President?

Result: Even with insane advantages, she may not get the Dem Nomination. (50-50) Even lower chance of beating a Reb.

B) Trump: 1) Everyone has seen Trump enough and has some idea of who he is. They understand what he is selling. The point is many are tried of 'weak' candidates and want someone to go to Washington and say: "Your Fired". The idea of a strong willed candidate appeals to a wide range of people. Thus, Trump's support is not ideological, but practical. With a few issues he has suggested he understands the basic person's situation.

2) Why? "Make America Great Again" The slogan is BY FAR the best of any candidate. He knows how to read the public and make a strong selling point. This is not to be underestimated because most of the other candidates have no idea how to do this.

The Reb nomination is currently his to loose. 25%

C) Bern: 1) Is not known enough by the general public, but a firebrand always has a place in American Politics. People can understand it and he does have many advantages.

2) A theme is both harder and easier for a firebrand.

Result: 35% chance of Dem. Nomination

D) Carson: 1) Like Bern a firebrand. 2) A theme really needs to be voiced that is more concise than his current talk. He needs a Trump advisor to get a witty slogan.

Result: 35%

E) Biden: 1) Son. that's a huge story and one that can propel him to a win

2) Much harder but if he can get a good one line reason: could be a winner.

Result: If he runs 50%, but 50-50 he runs

F) Reb Field:

It's really hard to figure the candidates out this far out and this many. I suspect one will make a stab at the two front-runers.

Result: 45% chance an 'established' candidate gets it.

If forced to pick today (this may change), I would guess a Biden-Carson race, but this has a low probability of happening.

Friday, September 11, 2015

Wednesday, February 25, 2015

Why oil prices will not 'Calm down', but may be headed for extreme volatility.

Saudi Arabia's Oil Minister Ali al-Naimi said:

"I don't like to talk about oil because we want calmness," Naimi said when questioned by reporters.

"Why do you want to bring up the prices issue? Leave the prices alone." [Reuters]

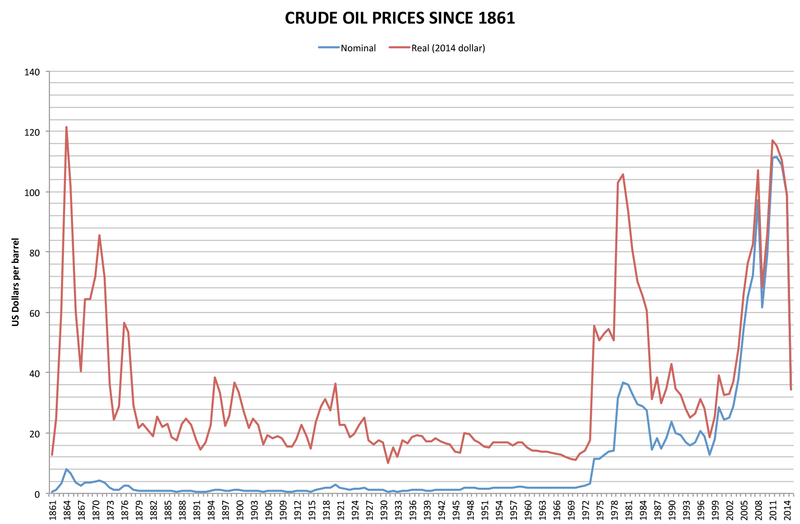

As long as OPEC will not change production based on market trends, the idea that oil prices should remain calm are false. History shows that oil prices are very volatile. The reason is easy for economists to explain. The demand for oil is very inelastic and the supply is also very inelastic. The result is small changes to either the demand or supply can force extreme short-term price responses. These extreme short-term fluctuations in oil prices can be seen in the long term chart below:

In fact oil prices were so volatile that the Texas Railroad Commission had a goal of price stabilization. "Before OPEC took center stage, one state agency in Texas was widely believed to set oil prices for the world." [The Texas Railroad Commission by William Childs].

If OPEC truly retreats from price setting, then almost by definition, oil price volatility will increase. Without a 'guiding hand' not just a small increase in oil price volatility, but volatility will skyrocket. For example, a range of $20-$200 every year is not out of the question. Why?

As stated earlier, the elasticity of BOTH supply and demand is very low. It takes a HUGE price swing to change either. For example, to cut supply it takes a price below the marginal cost of production. But with oil wells, almost all the cost is sunk. Most of the cost is to drill the well, not produce the oil. Thus, once the well is drilled it takes an absurd price to stop production (like $20). On the other hand, consumption is also inelastic. For example, to get people to trade in their electric car for a truck will require a huge change in price of gasoline. To change the consumption of gasoline, you need a huge change that wakes people up and occurs over time. Thus to get a 10% increase in gasoline sold, you need 50% or more change in price for many weeks if not months. Thus, for either supply or demand to change significantly, you need a HUGE change in price.

But that creates a problem over time. If the price falls to $20, demand jumps 6 months later. At the same time as wells deplete and no new wells are drilled, the amount supplied also falls. To get production increasing, you then need a price above $100. So the price starts to skyrocket. After $150, demand starts to decrease but supply surges and then you have too much oil. Now to get supply to decrease and demand to increase back to $20. Without OPEC changing production, the price will have to change dramatically down and dramatically up. The volatility of oil prices is headed to insane levels, if OPEC has truly stopped it's price setting.

The conclusion is either OPEC starts moderating price by changing production or the price of oil will become very very very volatile.

Sunday, February 1, 2015

Wednesday, January 7, 2015

Econ 101 for Oil

Many in the oil market seem to have forgotten Econ 101. To bring everyone on the same page, below is meant to be a refresher in case you forgot, never learned or just didn't care.

First, a demand curve goes downward from a high price and a low quantity to a low price and a high quantity. For example, at $15 a beer, you tend not to consume very many beers. But at 15 cents a beer, well......

Supply curves are just the opposite. They go from a low price and low quantity to a high price and high quantity. So if you are making hot dogs at a food truck the price and the quantity would be:

If you can only sell hot dogs for 50 cents, you might just stay home and sell zero.

But if you can sell hot dogs for $10, you are going to want to sell a zillion.

If all of a sudden Costco has a sale on hot dogs and you can buy them for 10 cents each, then at every price you want to sell more hot dogs than before.

For oil markets, the fracking/horiz/new technologies has meant that for every price, there is more oil.

Thus in the short-run (weeks), the following chart shows the impact:

But over time, things change. For example, at a low price most people will not buy a BIG car, fly more and in general use more oil. It takes time to schedule a vacation and buying a car is not done very week. But over several years, people will respond to low prices by increasing the quantity demanded at every price point. This is reflected in the charts below:

Notice how a price of $50 is required to clear the markets in the short-run, but a price of $90 is required in the long-run. This basic difference is a reason commodity markets can be very volatile.

Prices can go up by 100% or down by 50% in a very short time. To clear a commodity market in the short-run, prices have to go crazy.

This is why farmers want various programs to stabilize the price of corn (or other products). In oil, OPEC has preformed this role by increasing or decreasing production to stabilize the price.

But when OPEC decides not to stabilize the price, the impact can be more severe than if OPEC did not exist. Many people planned on OPEC to provide stable prices and thus planned their actions on this assumption. But when OPEC decides NOT to decrease supplies to stabilize price, the price needs to change more than normal and will stay lower longer than normal to cut production and stimulate demand.

Last, but not least, is the question: How long is the short-run vs long-run? When does the demand and supply curves change to less elastic curves? This has been a question on the Investor Village Board BRY for the past week. Some very good posters have argued that the supply and demand response would be fast, while others argue the supply response will take years. How fast is the response? Anyone who says they know for sure are wrong (even if in this case they lucky happen to be right).

Many factors go into the response of consumers and producers to changes in price.

1) The degree of price change. Many books and articles have been written about the 'tipping point' where at some price consumers and producers 'wake up' and suddenly change behavior. Thus, many who use straight line response models, are shocked at sudden and strong movements by consumers and producers.

2) Other economic factors. For example, if the consumers just got a pay raise, they might behave differently than if they just got fired. Thus a strengthening economy (the US currently) is a far different response than a declining economy.

3) Technological changes. Producers may be experiencing such a great change in technology that the costs are falling even more than anyone expects.

4) Political concerns. At a tipping point, both consumers and producers may be influenced by other factors, such as politics, geography and personal biases. These are near impossible to predict and can make fools of many pundits.

Given all these factors any estimation of oil prices in 2015, such as the price as of June 30 or Dec 31 is more of a guess than a scientific estimate. My personal view is the price could fall to some very low amount, but will rebound to $70s by June and $100 by Dec. But this is a wild ass guess and any price between $20 and $150 is possible.

Subscribe to:

Posts (Atom)