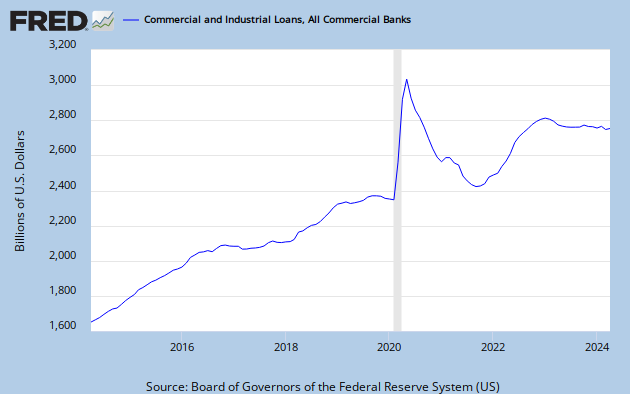

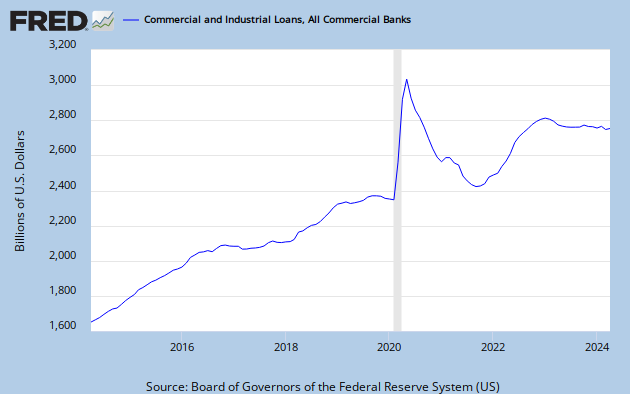

In this recession the nature of lending has changed. In most recessions, bank lending starts falling at the start of the recession. Banks seeing a problem start to tighten standards and stop lending. But in this recession, the banks INCREASED lending as the recession started and did not stop till July 09. But after July 09, the banks repaid TARP shares and lending has fallen like a rock. The rate of change of lending (2nd Derivative) has increased significantly. As a result, lending volatility has been increasing. In other words, in strong economic times the banks increase lending at a faster pace and pull back lending at a faster pace. Look at the following chart to see the increased volatility of lending.

Looking at the weekly data for large commercial banks shows the same pattern.

The data clearly show that in this recession the banks continuing lending until well into the recession. In July of 09, they reversed course in a dramatic way and starting decreasing lending at a furious pace. In fact, adjusting for accounting changes, the banks have decreased total loans outstanding by 10% since the start of the recession! This HUGE decrease in lending has to impact Main Street and the economy. Why did the banks reverse course and stop lending? TARP. In the first part of the recession, the banks received large amounts of capital. Below is the quote from the Sec. of the Treasury:

Although this program's primary purpose is stabilizing our financial system, banks must also continue lending. During times like these with a slowing economy and some deterioration in credit conditions, even the healthiest banks tend to become more risk-averse and restrain lending, and regulators' actions have reinforced this lending restraint in the past. With a stronger capital base, our banks will be more confident and better positioned to play their necessary role to support economic activity. Today banking regulators issued a statement emphasizing that the extraordinary government actions taken by the Fed, Treasury and FDIC to stabilize and strengthen the banking system are not merely one-sided; all banks – not just those participating in the Capital Purchase Program – have benefited, so they all also have responsibilities in the areas of lending, dividend and compensation policies, and foreclosure mitigation. I commend this action and I am particularly focused on the importance of prudent bank lending to restore our economic growth.As a result of this new capital, total loans increased, when in all prior recessions, the total loans decreased BEFORE the start of the recession. While some of the increase in loans was liquidity related, part was clearly related to the TARP and increased capital in the banks. When the TARP funds were allowed to be repaid, the lending starting to decrease at an dangerous rate. Look at the SHARP and dangerous decline in lending in any of the charts. The fall in lending since July 09 has been faster than any previous recession. Thus, the TARP actually did the job and slowed the economic impact of the financial crisis. Unfortunately, the Obama Administration, allowed the banks to repay the money and lending has fallen of the map. This decrease in lending will cause a 2nd recession and will cause tremendous economic problems for the economy.

Without immediate action to slow the decrease in lending, a further weakening in the economy is near certain. You cannot have a TEN percent decline in bank lending without dramatic and real impacts on the economy. Allowing the banks to repay TARP and no longer lend was a major mistake of the Administration and they will feel the impacts on unemployment and at the ballot box in November.

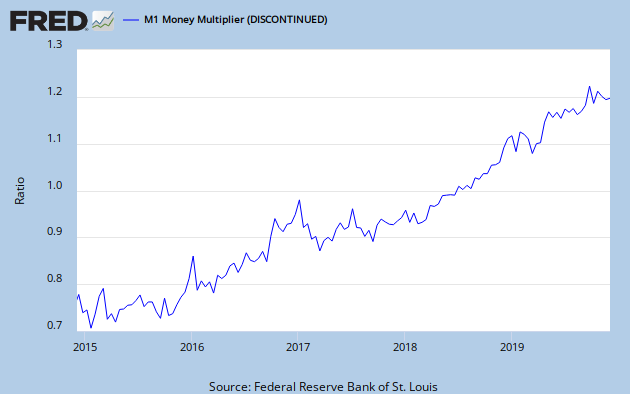

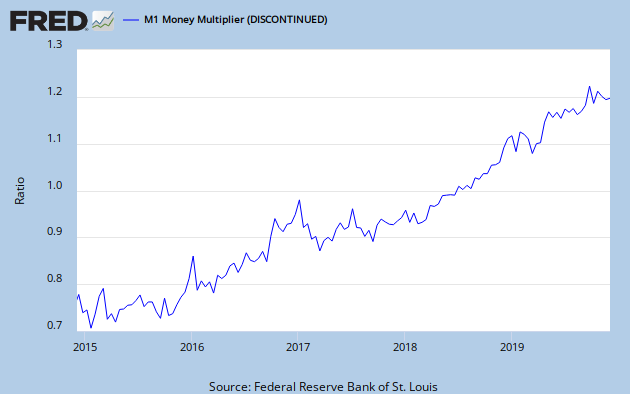

Given the large decrease in lending, inflation cannot be a problem. In fact, deflation is clearly a danger in a world where total lending is falling at 10% per year. The Fed must increase the money supply at a crazy high pace or face a very deep 2nd recession. Look at the money multiplier for additional problems:

Note the significant fall in the velocity of money during the MIDDLE of the recession. This is unprecedented and clearly a result of a significant change in actions by individuals.

With lending falling in the past year and velocity of money also falling, the economy must fall into a second recession. It is a simple fact that gross domestic output must equal the amount of money times the velocity of money. If both the money supply and the velocity are falling, then the output must also fall. With a significant portion of the US dollars used overseas, the simple equation is slightly more complex, but the point is still valid. A steep decrease in lending and velocity of money is going to force output to fall.

Because of the dramatic change in banking conditions, the Federal Reserve has an impossible task. They have to significantly increase the money supply to prevent a depression and at the same time be ready to decrease the money supply if the economy takes off. The ability of the Fed to change from a "stop depression" to a sharp increase in economic activity is near impossible. Right now, because of bank lending falling of the table, they need to pump money into the system. FAST. But once the economy starts to rebound and bank lending starts to increase, they are going to have to drain money at a very fast pace or inflation will skyrocket.

A sharp V shaped recovery off of a 2nd deep recession would be a very bad outcome for the country. Why expect such a sharp V? One reason is the emotional attitude of the consumer and producer. Many company executives are very uncertain about how the regulations will impact their business. Small business especially are very uncertain of the exact impacts of all the new rules and regulations on their operations. They simply do not know what to expect. This uncertainty will eventually be resolved.

Congress cannot without creating a depression, continue making new regulations for the economy. Once small business has a feel for the new regulations impact on their particular business and enough time has expired for them to find solutions, then they will be ready to explode their output. After several years, there will be opportunities that have gone unexploited. In essence a pent up demand for taking risk. Thus, after a 2nd recession, a sharp V recovery has to be a strong possibility.

But a strong recovery with an extremely expansive monetary policy will produce serious inflation. So the problem for the FED is that in the short run to prevent a depression they have to run an outrageously expansive monetary policy. But the moment the policy and economic forces turn, they have to turn off the spigot and drain money at just as a fast rate. A VERY difficult task for the Fed or any central bank.